Cloud Data Platform for Financial Services

Build better financial services faster, with less risk.

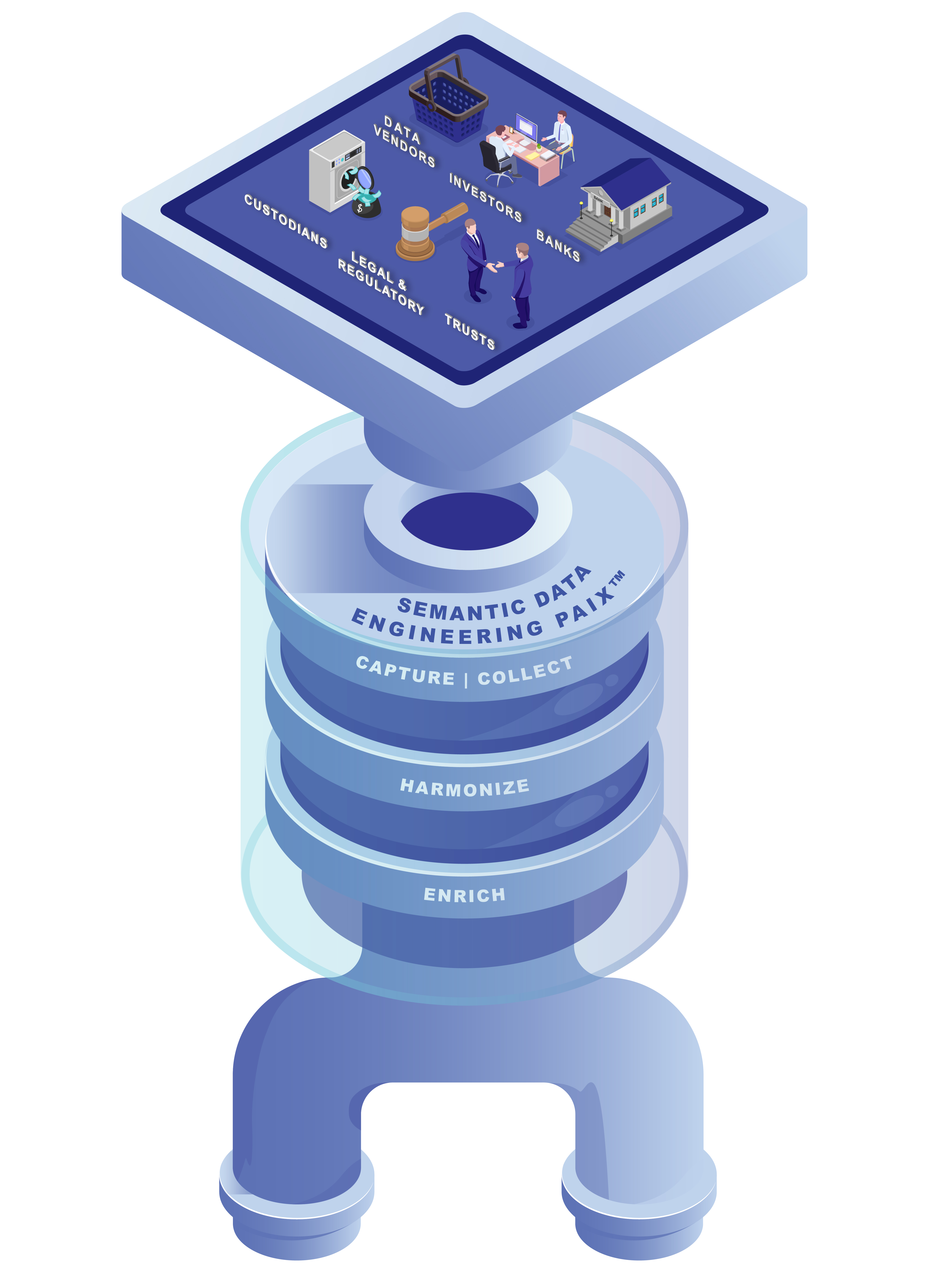

Ingestion & Integration

Automated data sourcing across thousands of different sources to create and curate detailed profiles of every holding, asset, transaction, cash flow, and client using the common semantics from a unified DiFi model called PAIXTM.

- Direct custodian feeds

- Held-away asset feeds

- Private placements

- Alternative Pricing

- Manually-entered accounts

- FX Rates & multi-Currency

- FX open contracts

- Tax lots

- Transactions

- Custom security master

- Benchmarks and constituents

- Liabilities

- Corporate actions

- Historical data as required

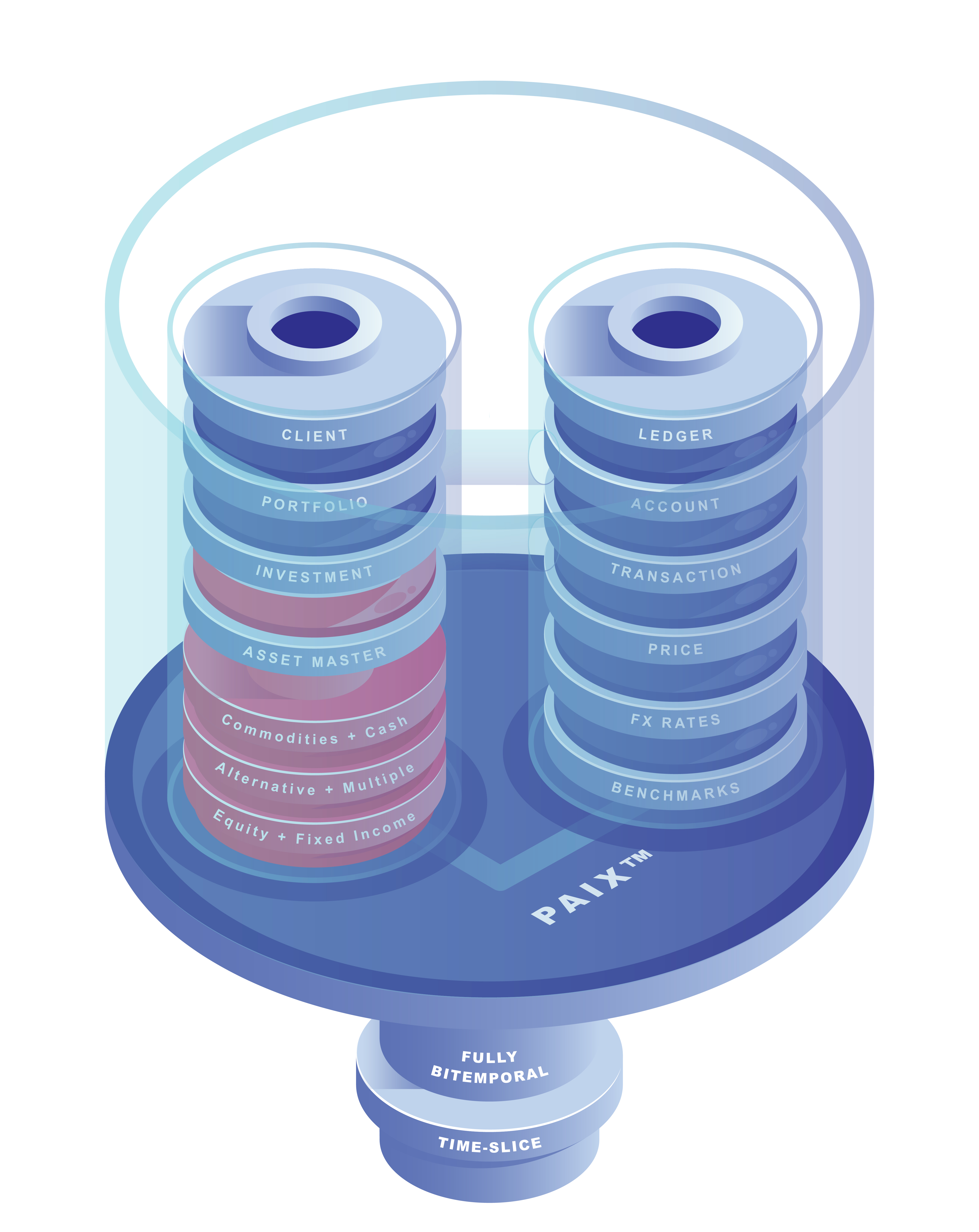

Model

A unified Protocol for Asset Information Exchange, PAIXTM, is used to harmonize all underlying data and data relationships into a single Accounting Book Of Record, ABOR, providing highly accurate and fully reconciled books and records quality data.

A single authoritative data model is used to harmonize all underlying data and data relationships;

- Unified Data Semantics

- Authoritative Definition of Relationships

- Consistent Meta Data

- Ease of Extension within the Financial Domain

- Ease of Cross Domain Integration

- Automated Data Governance

- Machine Readable Data Sets

- Ease of Navigation across Data Sets

Bitemporal

Bitemporal milestones with full support for back dated transactions and audited positions;

- Business and System Processing Dates

- Trade & Settlement Dates

- Daily and Monthly Activity

Distribution

Data can be provided as both human and machine readable, fully secured rectangular datasets with full meta data. Clients can also implement secure system to system integration for both data and derived data services via our REST API.

- System-to-System Integration

- Public Cloud Integration

- Private Cloud Integration

- Easy Tool Integration

- Enterprise Authentication

- Organizational Entitlement

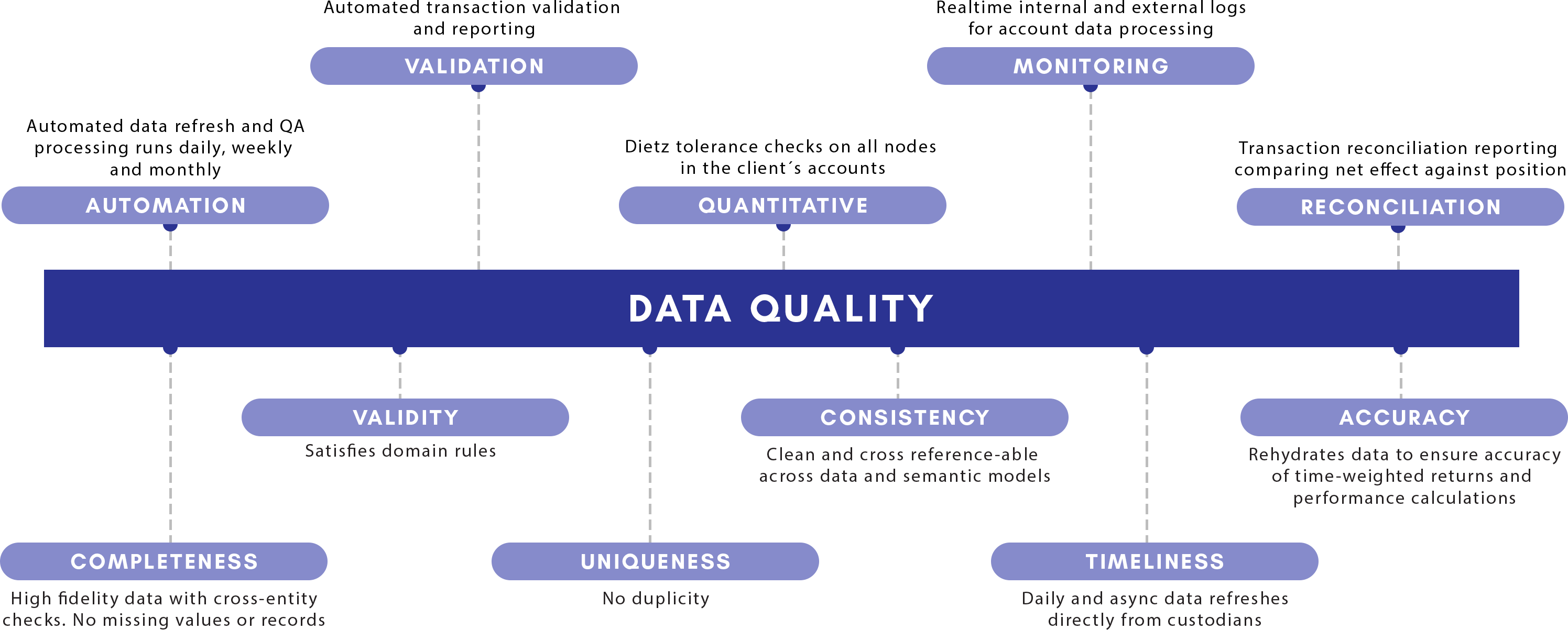

Quality

A foundational focus on achieving and maintaining high fidelity, fully-integrated data with the accuracy and availability required to drive mission critical business processes and analytics as differentiators for our partners and clients.